tesla tax credit 2021 georgia

Tesla cars bought after May 24 2021 would be retroactively eligible for a 7500 tax credit on 2021 tax returns. Report Inappropriate Content.

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

10 of the vehicle cost up to 2500 if you purchase or lease a low emission vehicle LEV.

. Jekyll Island Georgia Country Tesla Owner Model 3 Dec 20 2021 80 sonoswen said. The dates above reflect the extension. 20 of the vehicle cost up to 5000 if you purchase or lease a zero emission vehicle ZEV.

EV federal tax credit. Updated March 2022. The credit is 10 of the cost of the EVSE up to 2500 and cannot exceed the taxpayers income tax liability.

The average petrol or diesel vehicle has a BiK rate of 20 to 37 percent. Teslas 200000 tax deductible eligible vehicle number has been used. With the two added the EV credit you get is 7500.

If you install your photovoltaic system in 2020 the federal tax credit is. Georgia Power customers may be eligible to receive up to a 250 rebate for installing a Level 2 Charger in their home. Tesla Model X Tax Write Off 2021-2022.

If you purchased or leased a vehicle on or before this date you can get a Georgia income tax credit of. What Small Business Expenses are Tax. Oct 29 2021.

The new law extends the vehicle count to 400000. Income Tax Letter Rulings. For Teslas this isnt a problem as the minimum is well over this threshold.

Heres a comprehensive guide to help you figure out if your electric vehicle still qualifies for any federal tax credit and state incentives. Any vehicles purchased after that date are no longer eligible for the Federal credit due to the number of vehicles manufactured. Income Tax Credit Policy Bulletins.

In the House version an 8000 tax credit excluding the Model 3 Performance S and X but in the Senate version a 10000 tax credit excluding the Model 3 Performance S and X on 2022 tax. Georgia Tax Center Information Tax Credit Forms. Income Tax Credit Utilization Reports.

Are Any Other Manufacturers Close to. So based on the date of your purchase TurboTax is correct. If the Build Back Better Act does not pass then I think the current 2021 tax credits would remain until the maximum number of cars sold is exceeded.

Under the proposed Build Back Better Act Tesla vehicles will still be able to get a 10000 portion of the tax creditfar better than 0. 48-7-4016 has been discontinued effective July 1 2015. So if someone wants a Rav4 Prime it would probably be best to purchase a new 2021 or 2022 model this year unless they dont owe enough taxes in 2021 to cover the 75K credit.

Tesla cars bought after May 24 2021 would be retroactively eligible for a 7500 tax credit on 2021 tax returns. Tesla tax credit 2021 georgia. Company Car Tax Benefit in Kind From 6th April 2021 both new and existing Tesla cars are eligible for a 1 percent BiK rate for the 202122 tax year.

Beginning on January 1 2021. Tesla cars bought after December 31 2021 would be eligible for. Start date Aug 8 2021.

The IRS tax credit for 2021 Taxes ranges from 2500 to 7500 per new electric vehicle EV purchased for use in the US. Several months later it seems that revisions to the credit are returning to lawmaker agendas. This nonrefundable credit is calculated by a base payment of 2500 plus an additional 417 per kilowatt hour that is in excess of 5 kilowatt hours.

After the failure of the Build Back Better bill in late 2021 the existing proposals for the expansion of the EV tax credit were abandonedThe EV tax credit remains at 7500 for all electric models except those made by Tesla and General Motors. For Teslas bought on or after January 1 2020 there has been no federal tax credit. On top of the initial 4000 tax credit you get an extra 3500 if the battery pack is at least 40 kilowatt-hour.

The Federal tax credit for Tesla vehicles was phased out to zero at the end of 2019. 2021 Status of Federal EV Tax Credit. Under the proposed Build Back Better Act Tesla vehicles will still be able to get a 10000 portion of the tax creditfar better than 0.

EV Federal Tax Credit for 2021 Tesla. The IRS tax credit for 2021 Taxes ranges from 2500 to 7500 per new electric vehicle EV purchased for use in the US. The BiK rate will rise to 2 percent in 202223 being held at 2 for 202324 202425.

A certification by the seller is required. The federal solar investment tax credit will have the biggest impact on the cost you will face to go solar in Georgia This perk is commonly known as the ITC short for Investment Tax Credit. Statutorily Required Credit Report.

Low Emission Alternative Fuel Vehicle LEVZEV and Medium Heavy Duty Vehicle MDVHDV Tax Credits in Georgia. 20 of the vehicle cost up to 5000 if you purchase or lease a. How Much is the Electric Vehicle Tax Credit for a 2021 Tesla.

Essentially getting more of that sweet sweet tax credit for themselves. FAQ for General Business Credits. Tesla Could Receive a Bump From a New 7000 Tax Credit Proposed reforms for the federal incentive program for electric vehicles would grant Tesla access to.

In May 2021 the Senate finance committee considered the Clean Energy for America Act that suggested modifications to a number of existing programs associated with clean energy among them being the EV tax credit. The Clean Energy Act for America would benefit Tesla by allowing most Tesla vehicles to qualify for an 8000 House version or 10000 Senate version refundable EV electric vehicle tax credit while discouraging Chinese EVs from entering the US market. Qualified Education Expense Tax Credit.

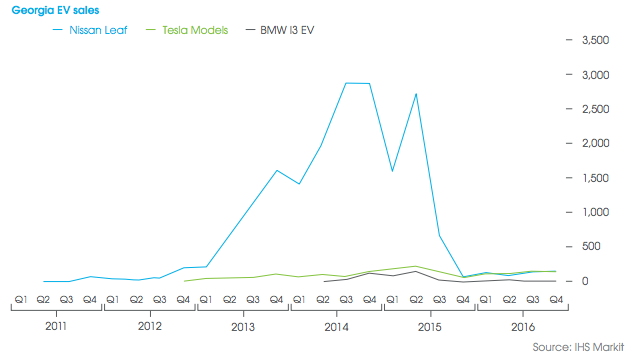

In Georgia the state legislature ended the 5000 credit for BEVs in 2016 but it is currently evaluating new incentives for vehicles and charging equipment. Tesla has been selling the Model S Model X and Model 3 for years already and GMs eligibility for any portion of the tax credit ended March 31 2020. So no EV tax credit getting passed before end of 2021.

LowZero Emission Vehicles - The current GA Low Emission Vehicle LEV and Zero Emission Vehicle ZEV Certification Program OCGA. Rebates are available through December 31 2021. Tesla and GM are set to regain access to tax credit worth 7000 on 400000 more electric cars in the US with new proposed reform of the federal EV incentive program.

Pre Owned 2021 Tesla Model S Long Range Refresh With Yoke Steering Hatchback In Raleigh Ps52636 Reggie Jackson Airport Honda

Rivian Hopes Its Electric Vehicles Will Help Save The Planet But Will Georgia Drivers Buy In Wabe

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Opinion Biden S Ev Tax Credits Redistribute Wealth Upward The Washington Post

As Georgia Recruits Electric Vehicle Maker Rivian The Number Of Evs And Charging Stations Lags

Used 2021 Tesla Model 3 For Sale In Newnan Ga Vin 5yj3e1eb0mf919051 Hendrick Automotive Group

Electric Car Tax Credits What S Available Energysage

Current Ev Registrations In The Us How Does Your State Stack Up Electrek

Latest On Tesla Ev Tax Credit March 2022

Edmunds Elimination Of Federal Tax Credits Likely To Kill U S Ev Market Wrong Evadoption

Updated 17 States Now Charge Fees For Electric Vehicles Greentech Media

Latest On Tesla Ev Tax Credit March 2022

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

The 12 500 Ev Tax Credit 2022 Everything You Need To Know Updated Yaa